We have nothing to fear but fear itself.

Franklin D Roosevelt, Inaugural Address.

We recently set out a three-point plan for Mr Johnson in which the first stage is a rigorous lockdown in order to save lives during the corona virus outbreak, the second stage is a managed rebound to ensure that the economy recovers strongly as possible while minimising the risk of secondary outbreaks, and the third stage is building a better world by implementing the five key actions recommended in the book 99%.

But Stage III will only work if it is put into practice, and there may be powerful voices arguing against that. Stage I, and to a lesser extent Stage II, have serious economic costs, and it is quite plausible that by the time we exit Stage II, government debt:GDP will have risen to over 100%.

Some people will present this as a catastrophe which risks bankrupting future generations if it is not tackled immediately. Their argument will go that, while we had no choice but to spend to get through the crisis of the virus, it would be irresponsible not cut spending immediately to bring the debt down through renewed austerity. We can already see calls in the some sections of the press and from some think tanks along these lines.

Do these writers have a point? Should we be afraid of the debt? Is austerity a reasonable response? No. Their argument fails to understand either the general issues involved or the specifics of the economic contraction that lockdown is producing. We should resist the calls for Austerity II.

Their Argument Fails To Address The General Issues

Although it sounds plausible – partly because we have heard it so many times before – the argument that debt:GDP of 100% is somehow ruinous is nonsense. And the household analogies that are often used to justify austerity are flawed. Finally the “magic money tree” argument that there simply isn’t enough money fails on many counts.

Debt At 100% Of GDP Is Neither Unusual Nor Dangerous

100% sounds like a magic number. Emotionally, exceeding 100% feels as if the Rubicon has been crossed. In reality, it is no such thing.

Here are the data from the Bank of England showing the last 300 years of Debt:GDP.

The chart makes several things clear which are seldom reported:

- The small parts of the graph which are normally presented are misleading: they create the scary impression that debt has been shooting up in a way never seen before. It has been seen before.

- 100% debt:GDP is not “astronomical” or “huge”; it is not even rather high; it is the average that we have seen in the UK over the last 300 years. If there is such a thing as normal, 100% is it.

- High debt does not bankrupt future generations. Debt:GDP was over 200% at the end of the Napoleonic wars, but that did not prevent Britain having an industrial revolution and experiencing some of the fastest growth in its history. Debt:GDP was over 250% at the end of World War II, but that did not prevent Britain from experiencing the Golden Age of Capitalism.

- High debt levels can fall very quickly if there is a fast-growing economy.

A Government Surplus Is Not Like A Household Surplus

Politicians often say things like, “every housewife knows that you can’t keep living beyond your means.” And this is rhetorically powerful because it relates to people’s everyday experience. When politicians infer from this that the same thing applies to a government, however, while it still has rhetorical power, it is logically false.

We have all heard the argument that governments should behave like prudent housewives so many times that it is hard to believe that it could be fatally flawed. But it is. And your own experience will show you that.

We all have experience of buying things. And every time we do that, cash changes hands. If I buy a bottle of beer for £1.25 in a shop, there is a cash-flow with two ends: at my end of the transaction the cash is -£1.25 and at the shop’s end the cash is + £1.25, and the two ends sum to zero. And this is true for every purchase that I have ever made, and indeed for the sum of all purchases made in the UK during the last year.

This has two simple but very profound implications:

- each person’s expenditure somebody else’s income;

- if you add up both ends of every transaction in the whole economy, the total is zero.

The first point implies that a society in which everybody is trying to cut their own expenditure is a society in which everybody is trying to cut everybody else’s income. And of course, if they succeed, the result is economic contraction.

The second point implies that if you split the economy up into different sectors, for example a domestic UK sector and a foreign sector, the total of all activity (again adding up both ends of each transaction) will be still be zero. If the foreign sector is showing a surplus, the domestic sector will show a deficit of the same absolute value.

And if we split the economy three or more ways, the same principle will hold. Usually we split the domestic sector into two and talk about a public sector, a private sector and the foreign sector. For these three sectors, the total of the surpluses/deficits will again be zero.

In the UK, we run a persistent trade deficit, which means that the foreign sector has a surplus. If the government were also to run a surplus or even just ‘balance the books,’ that would condemn the private sector to a deficit. So one thing we can be sure of is that if the UK government tries to run a permanent surplus, prudent housewives and businesses will be condemned to a deficit. And if they respond by cutting their own expenditure as prudence would suggest, economic contraction will be the result.

Governments really should not run like households. And in practice, they do not. Although politicians quite often talk about running a balanced budget or a surplus, it is rare that they do so – and when they do the result is usually an economic slowdown or a recession.

Of course, you cannot push this argument too far. The government could not realistically run deficits of 10% or more of GDP in perpetuity without the debt:GDP ratio continuing to rise. But, if huge deficits for a year or two are needed to stabilise the economy and protect the population, there should be no cause for concern about this.

The One Thing the Government Cannot Be Short of is Money

I can already hear you saying, “But surely if they don’t run like households, they will run out of money? No Business would run like that; they would be declared bankrupt.”

Actually, big businesses often do run with ever-growing debt. Here is BP, for example.

BP’s turnover has grown enormously over the last 40 years, and its debt has also grown. Most years, it has borrowed to plug the gap between the cash that comes in (through business operations and injections from shareholders) and the cash that goes out. And there has been no suggestion over this time that BP was going bankrupt. The same is true for the government.

And the government has a huge advantage over BP. It can create money (via the Bank of England). After the Global Financial Crisis, the Bank of England undertook Quantitative Easing – it created money electronically. The total amount created after the crisis was over £400 billion, and is now almost £650 billion. In addition, there was almost another £1 trillion in loan guarantees to banks.

These eye-watering amounts of money were created painlessly, at the touch of a keyboard, and contrary to some expectations (though by no means all) they did not produce hyperinflation. £650 billion is roughly 4 years’ budget for the NHS, and it was created out of nothing.

The one thing the government cannot be short of is money.

So, even if the corona contraction were a normal recession, the arguments we normally hear to justify austerity would not be sound. Government debt to GDP is not at ruinous levels; governments should not behave like households; and there is no possibility of running out of money.

It Also Fails To Address The Specifics Of The Corona Contraction

The corona contraction is not a normal recession. And this means that we should think differently about how to handle both the contraction itself and the aftermath to protect both supply and demand.

The corona contraction is not like a normal recession

This is an economic contraction that we have deliberately aimed for, in order to enable social distancing and contain the virus. It was not caused by a sudden shock to productive capacity such as would result from a global embargo on oil trade. It was not caused by a sharp reduction in demand like the Great Recession that followed the financial crisis. Broadly speaking, before the virus, both supply and demand were intact.

This means that we should aim to keep them both intact as far as possible. In the book 99%, we use the analogy of an economic pie of which everyone gets a slice. Inevitably, as a result of the corona contraction, the pie will be somewhat smaller than it would otherwise have been, and this will inevitably cause some people to be worse off. But to the extent that we can protect the size of the pie, we should do so.

Ensuring a rebound means protecting supply…

The contraction means that there has now been a very sharp reduction in demand for many goods and services. For businesses which have been ordered to close, the reduction is 100%. But others also find that demand has reduced significantly because many people are now working less or not at all and simply cannot spend at previous levels.

But businesses have outgoings, whether or not their demand is maintained, and the risk is that many otherwise viable businesses will go to the wall during the contraction. If that happens to any great extent, then even if demand were to rebound, the supply would not be there to meet it, and the recovery would be anaemic at best and stagflationary at worst.

So an imperative for government is to ensure that capacity does not contract significantly in the downturn. The UK government has announced measures to protect businesses; they will need to keep these in review and strengthen them if a collapse in capacity seems likely.

… And protecting demand

But the demand side is at least as important. Many households will see their finances weakened, some significantly, and there is a real risk that, as after the Global Financial Crisis, people either cannot or dare not spend. This is both a personal and economic tragedy.

There is only one way both to engineer a contraction and to shield the population from the worst of its effects, and that is for the government to take responsibility for protecting its citizens.

We Should Take All Possible Steps To Avoid Austerity II

We have seen that, even though the costs of managing the contraction will be very high, if Austerity II happens, it will have been a choice – not a necessity. And since we have the choice, we should choose not to do it. Austerity II would be worse than Austerity I, so we need to think now about how to prevent it happening – and that will include getting the message into the public domain very quickly.

Austerity I Had Terrible Effects But Austerity II Would Be Worse

Austerity I was both an economic and a personal disaster. Economically, growth in GDP per capita has been negligible over the last decade, and most people’s wages have not risen at all. By comparison, the much-derided 1970s showed far better performance. And personally, many lives have been ruined and, according to the British Medical Journal, well over 120,000 have been lost. Austerity I did not even succeed in reducing debt:GDP. It was a failure on every measure.

And that was starting from a base where most public services had been reasonably funded. For the last 10 years they have not, and they are all beginning to creak. We have lost 20,000 police; and many police forces now struggle to respond to crimes like burglary, simply because of lack of resources. Local authority funding has been slashed; and social care and many other services are now in crisis. And of course, the NHS has been underfunded – and we can clearly see the risks to which we are exposed as a result.

A second round of austerity would compound all of these things: mass impoverishment would continue to hollow out the middle class; the lives of those at the bottom of the pile would become ever harder; and the support that they could expect from the state would be ever more inadequate.

We should think creatively about how to prevent it happening

There are three ways that the government could fund the expenditure we are suggesting, and only one of them is currently on the agenda.

The first way is through borrowing – and this is the current plan. Government borrowing at the moment is extremely cheap, and as we pointed out above even if debt:GDP were to exceed 100%, that has no real economic significance. So, on the face of it the decision to keep borrowing seems rational.

Debt hysteria, however, is not rational and there is a very real risk of loud and strident voices persuading the British public that there is no alternative to renewed cuts in public spending. So it is worth considering the other two options.

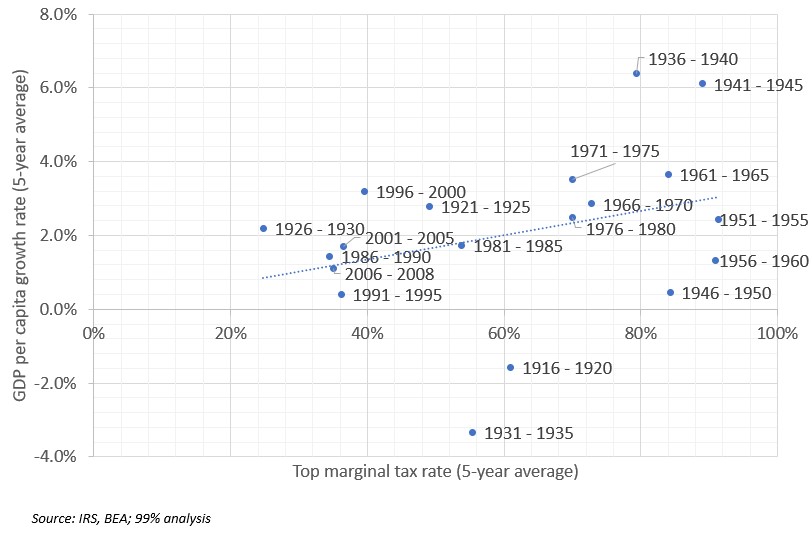

The second option is through higher taxation, and in the long run, there are some strong arguments for this: the biggest single driver of mass impoverishment is rapidly rising inequality, and progressive taxation can help with this. Surprisingly, it might also spur faster growth. Despite the rhetoric which says that higher taxes kill growth, there is no evidence of that in the data. Here, for example, are the US data, and they show that if there is a correlation between taxes and growth, it works the other way.

If this link is real, it is probably because $1 in the hands of a poor person gets spent straight away on consumption, whereas $1 in the hands of a rich person is much more likely to be saved or ‘invested’ – and the investment may well be in some pre-existing capital rather than in new capital formation. The rich are as likely to buy stocks and shares, or a Picasso, or a house as they are to invest in purchasing new equipment to grow a business (especially if demand is not visible). Giving $1 to a poor person makes it ‘work harder’ than if you give it to a rich one. So progressive taxation should certainly be in the mix – but maybe not before the effects of the corona contraction are behind us.

Which brings us to the third possibility: money creation. Money creation is often dismissed out of hand on the basis that it would inevitably lead to hyperinflation. In fact, hyperinflation happens not just when money is created (which under normal situations it is in large volumes by commercial banks) but when money creation coincides with a supply shock – ‘too much money chasing too few goods.’

Lord Turner points out that there is no technical reason why money finance in moderate amounts should produce excessive inflation. Others have gone further. In the US, several economists, including the Nobel Prize-winning Paul Krugman, have supported the idea of a $1 trillion coin:

“Treasury [is allowed] to mint platinum coins in any denomination the Secretary chooses… And by minting a $1 trillion coin, then depositing it at the Fed, the Treasury could acquire enough cash to sidestep the debt ceiling – while doing no economic harm at all.”

Similarly, in the UK, if the government minted three £500 billion coins and deposited them in a non-interest-bearing account of the Bank of England – not for spending, just to look at – they would have zero economic effect. But they would have a powerful psychological effect. UK government debt is around £1.8 trillion. With three coins, net debt would be reduced to around £300 billion, or about 15% GDP. This is lower than it has been at any time since 1700. The idea that ‘the state of government finances’ makes action unaffordable would be blown out of the water.

So there are no fewer than three ways of avoiding a damaging return to cuts in public spending. We should use them all rather than allow ourselves to be persuaded that there is no alternative to Austerity II.

And That Means Getting The Message Out Quickly

After the Global Financial Crisis, the media successfully created the impression that most economists were in favour of austerity and that it was the only responsible course of action.

The Times published a letter purporting to be the voice of the economics profession which called for deficit reduction to be the new government’s number one priority. Two academic papers received enormous publicity: one claimed that austerity and tax cuts were better for growth than public spending, and the other that if debt to GDP were to exceed 100%, growth would be severely curtailed. Both of these papers were subsequently found wanting, but by then the damage was done. The message that austerity was the only responsible choice had become mainstream.

Austerity I was duly implemented, and it both shrank the pie significantly (relative to what should have been expected) and sliced it less fairly. It did not even succeed in rebuilding public finances.

It is important that that does not happen again. Simon Wren-Lewis has spoken about the need for the economics profession to have a clear voice. If ever there was a time for that voice to be heard, it is now.

In conclusion, there is no reason why we should be duped into Austerity II, but the risk is nevertheless very real. What we should be doing is following the three-point plan, and making sure that we do build a better world once the crisis is over. Those of us with voices need to use them now.

If this matters to you, please do sign-up and join the 99% Organisation.

[With thanks to Martin Wolf for his input on this article]

5 comments so far

At last! I’ve just finished reading 99%, this is probably the first economic text that left me feeling clearer-headed rather than more confused! That in itself is quite an achievement. I intend to go over text some more times, not to brainwash myself but so as to have the arguments to mind.One question springs to mind: Who or what institution has benefited from the failed attempt to reduce our national debt? Generally it is the lenders who benefit most from indebtedness, it is often said that the last thing a bank wants is for all its clients to clear their debts. Is this just another example of the same??

Thank you!

I think that the simplest answer is that the crisis was a gift to those who had always wanted to reduce the role of the state and move the UK to a small government, low tax model. It gave them a very plausible narrative to justify otherwise unpalatable actions, and it made them money.

I’m confused about the £500bn coins bit. If UK has debt it is borrowed from selling gilts right? Mostly this is the private sector. Repaying the debt to reduce it as you say would mean the money flowing out and around and not just sitting to look at?

Or are you saying let’s have these coins and say look our net cash is looks better without actually repaying? This doesn’t seem to make sense either since actually repaying would contribute to inflation surely?

If the government created (say) £ 1 trillion in new money, deposited it in a non-interest-bearing account at the Bank of England and kept it there, it would not take part in any economic transaction and therefore it would not drive inflation. It would, however, have the powerful effect of reducing government debt — at a stroke — from around 100% of GDP to around 50%.

This would demonstrate the emptiness of the (rhetorically extremely powerful) arguments the government has employed to justify starving the NHS and other public services of money on the grounds that the debt was “unaffordable.”

If you turned the Bank of England Chart into a Control Chart it would illustrate the extent to which the ratio was actually “in control”, i.e. within the variation limits of the process over time